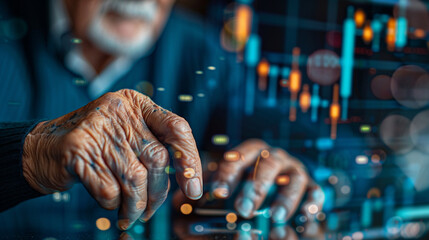

Retirement planning is a crucial aspect of financial stability in one’s golden years. While there are various retirement options available, a personal pension plan offers a tailored approach to saving for retirement. By customizing a personal pension plan, individuals can ensure they have sufficient funds to enjoy a comfortable retirement lifestyle.

Understanding Personal Pension Plans

A personal pension plan is a long-term savings vehicle designed to provide income during retirement. Unlike employer-sponsored pension plans, personal pension plans are set up individually by an individual. Contributions are made regularly, which are then invested in a range of assets such as stocks, bonds, and mutual funds. The goal is to accumulate a sizable retirement fund over time that can provide a steady income stream once the individual retires.

Benefits of Customizing a Personal Pension Plan

- Flexibility: One of the key advantages of a personal pension plan is the flexibility it offers. Individuals can choose how much they contribute, how often they contribute, and where their contributions are invested. This flexibility allows individuals to tailor their pension plan to suit their financial goals and risk tolerance.

- Tax Benefits: Personal pension plans offer tax advantages that can help individuals save more for retirement. Contributions are typically tax-deductible, which means that individuals can reduce their taxable income and save on taxes. In addition, the investment growth within the pension plan is tax-deferred, allowing the funds to grow faster over time.

- Lifetime Income: Upon retirement, individuals can use their personal pension plan to purchase an annuity or opt for regular withdrawals to provide a steady income stream. This ensures that retirees have a reliable source of income to cover living expenses and enjoy their retirement years without financial stress.

Steps to Customizing a Personal Pension Plan

- Assess Your Financial Situation: The first step in customizing a personal pension plan is to assess your financial situation. Evaluate your current income, expenses, assets, and liabilities to determine how much you can afford to contribute to your pension plan.

- Set Financial Goals: Define your retirement goals and objectives. Consider factors such as when you want to retire, how much income you will need in retirement, and any specific expenses you may have. This will help you determine how much you need to save and invest in your pension plan.

- Choose Investment Options: Research and select suitable investment options for your pension plan. Consider factors such as your risk tolerance, investment time horizon, and potential returns. Diversifying your investments can help reduce risk and optimize returns over the long term.

- Monitor and Adjust: Regularly monitor the performance of your pension plan and adjust your contributions and investments as needed. Review your plan annually to ensure that it is on track to meet your retirement goals and make any necessary changes.

Conclusion

Customizing a personal pension plan is an effective way to save for retirement and ensure financial security in your golden years. By assessing your financial situation, setting goals, choosing appropriate investments, and monitoring your plan regularly, you can tailor your pension plan to meet your individual needs and preferences. Start planning for your retirement today and take control of your financial future with a personalized pension plan.